Make Sure You Can Prove Your Gold Is Yours!

Dr. Gary North was always one talking about “digits” and how they are just numbers in a computer that can be erased or changed. Print out an account statement on paper, he would say, for “the day the digits die”.

Whether or not I think there is a high probability that some day the digits do die, I believe in printing out the occasional hard copy statement of my financial accounts – including precious metals – just in case.

BullionVault vs GoldMoney: Account Statements

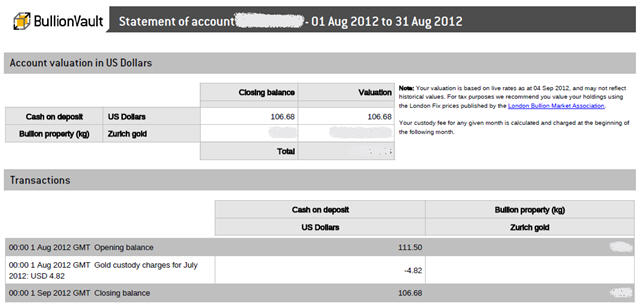

With BullionVault you get an account statement emailed to you, in PDF format, at the beginning of every month for the previous month.

Sure, some would argue that it would be more secure to email you a notice that your statement is ready for download and have you login securely to your account and download a PDF statement – and I would agree. Perhaps BV is open to suggestions?

Here is what a BullionVault monthly statement looks like:

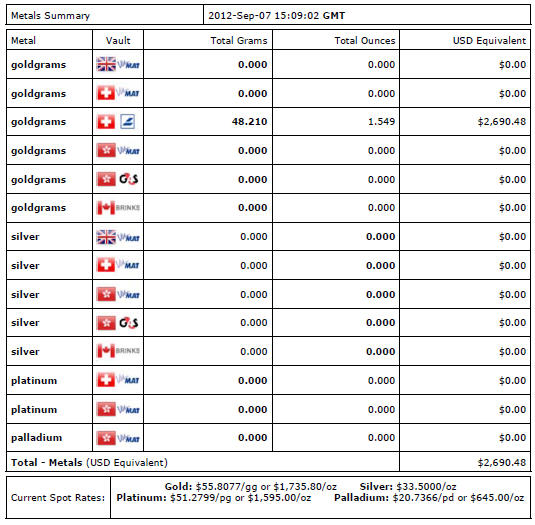

But with GoldMoney, not only do they not email you a statement, nor a notice that it is ready for download, there is no such statement available at all in a concise, specific date, format.

You can login to your GoldMoney account, find “statements” and print out what your cash (potentially in multiple currencies) and metals are worth at that moment, but that’s it. If you want an end-of-the-[month | quarter | year] statement you need to set a reminder to login at that time and generate your statement then.

It will have both a “metals summary” and a “currency summary” and a total of the two. Here is what the “metals summary” looks like:

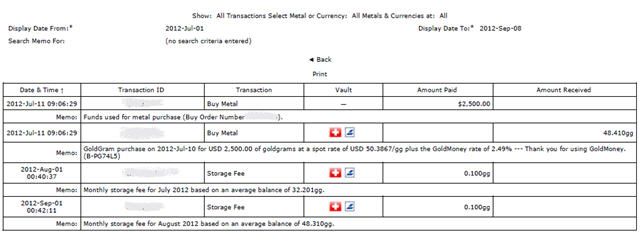

At GoldMoney you can also print a history of transactions from one specified date to another but be sure and check the box for “generate printer friendly”.

See an example below:

But with accounting in my background, I like to have set values on set dates, such as end of month, end of quarter and end of year.

With GoldMoney, you have to remember to go in and generate whichever statement (or both) you want, when you want it.

This is not the kind of difference that will glaringly decide for you whether to buy and store gold at BullionVault versus GoldMoney, but it might tip the scale for you towards BullionVault.

Remember, we use and recommend both for diversification if your holdings are large enough. As you can see from the GoldMoney Statement screenshot, the minimum is 0.10 goldgram per month storage fee, which is kind of painful on small accounts.

BullionVault is Cheaper Storage AND…

There is a lot more bullion stored in the BullionVault account above than there is the GoldMoney account; yet notice that the monthly storage charge is less than US$5 at BullionVault and taken out of cash.

The MINIMUM monthly storage charge at GoldMoney is 0.10 goldgrams, currently about US$5.50 and it’s taken out of your GOLD – with income tax ramifications – as we detailed in our previous blog post about an advantage of BullionVault over GoldMoney.

Sometimes you get what you pay for and other times one option is just a better value than the other; again, we use both companies. YOU decide what’s best for YOU!

Open an account at BullionVault

If this comparison between BullionVault and GoldMoney has been helpful to you, please leave a comment below, “like”, “plus” or otherwise share it. We appreciate your input and support!