Soaring Gold Price Causes Stocks To Soar

Most precious metals enthusiasts know that Gold Stocks (companies) are leveraged to an increase in Gold Price.

At times in the past, certain ones became LEGEND. Unfortunately, Gold bulls have been waiting a LONG TIME to see that happen in their portfolios.

This author is one of them.

In fact, Wheaton Precious Metals is not even a mining company and it holds the record in our portfolios over the last 20 years or so.

Wheaton is actually a royalty company that was named Wheaton Silver back when we bought it.

The key is to invest in a company – if that’s what your goal is, as per the headlines above – where:

the price of Gold going up positively affects revenue while expenses stay pretty much the same.

It’s a wonderful thing!

A Warning About Gold Stocks

Yet, as great as that all sounds…

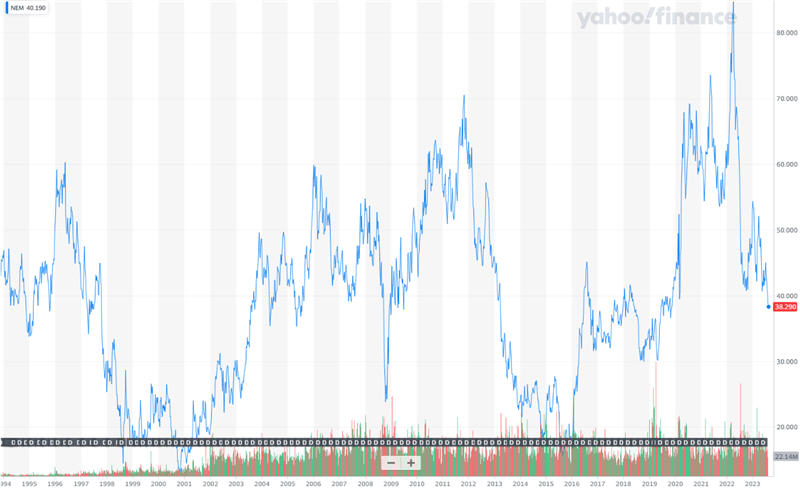

Gold stock investors are mostly disappointed over the last, well, this century!

Not too impressive for a company most consider a ‘blue chip’ in the sector.

Which is why most of your big name mutual fund families offering a portfolio of Gold Mining Stocks have poor performance for a long time now. With essentially zero dividends paid to you as well!

There are just so many factors AGAINST a mining company like:

- Jurisdiction

- Environmentalists

- Greedy Politicians

- Remote Geography (Hard to get to)

- Harsh Climate (Think Canada, and worse)

- Super Expensive Equipment

that making a profit can be tough!

And that’s so long as the price of the underlying commodity cooperates. In this case, Gold!

Specialized Knowledge Key To Stock Picking

I am telling you from personal experience that creating a portfolio of Gold stocks (same goes for Silver) based on casual reading online will end in disaster.

Unless you somehow get EXTREMELY LUCKY.

And I’m not going to recommend Seeking Alpha or any other site either – again, past results!

Gold companies are often run by dreamers and/or shysters (as my dad calls them), who will tell you all the POTENTIAL positives and not even bother with ACTUAL negatives!

To make money in this sector you want help from a rock kicker who visits the actual mine. YES, a select few do that!

Lobo Tiggre (his actual name) is my guy I’ve used to increase my portfolio returns. Lobo came up in the newsletter business under Doug Casey, learned a lot, and went out on his own founding The Independent Speculator.

The newsletter can help you outsize your resource stock returns in several ways.

Let me tell you how:

- Start by subscribing to his free weekly (Saturday Afternoon) e-letter. You WON’T BE SPAMMED! (Click here)

- If you like what you read and are ready for the next step, I recommend comparing your portfolio to his extensive database of stock evaluations. Very modest subscription fee required for what he calls “My Take“.

- Once you gain confidence in Lobo Tiggre, his team and his style, I highly recommend the full service flagship newsletter (which includes My Take) -> Subscribe to The Independent Speculator

As a reminder, or if I didn’t make this clear…

The Independent Speculator services are for RESOURCE STOCKS only!

For the most part, this includes:

- Gold

- Silver

- Uranium

- A smattering of lesser precious metals, oil & gas and ‘rare earth’ companies may be included

The My Take index is extensive yet may not include EVERY stock in your resource stock portfolio.

Another Service Set Apart

So let me blow your mind a little.

When was the last time you contacted an investment newsletter service, asked them to take a look at a stock you own and actually had them DO IT?

Well, no guarantees because they’re busy, but if you contact them (as a subscriber) and ask about XYZ stock that’s not currently in The Independent Speculator My Take index – there’s a pretty good chance they’ll put it on the list and get to it sooner rather than later.

Just another tidbit about how Lobo Tiggre is set apart from ‘all the other guys’.

Ok, I’ve rambled enough!

Take a look at The Independent Speculator site and see what you think. Learn more by clicking here now.