Are Numismatic Gold Coins Better?

We received an email today from a coin dealer that we have done business with and do trust.

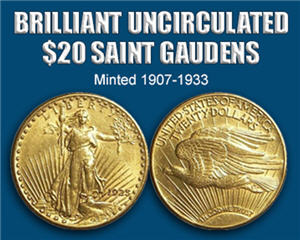

The offer was for brilliant uncirculated $10 Saint Gaudens Gold coins for $195 over spot – supplies extremely limited.

(For reference: A current Gold Buffalo is $57 over spot and an Australian Kangaroo is $37 over spot.)

While it sounds like a gimmick, I suppose supplies of brilliant, uncirculated 80 – 100 year old Gold coins probably are limited.

Does that mean you should buy these Gold coins?

The Argument For Buying Numismatic Coins

I have seen two primary arguments for buying numismatic Gold coins, aside from the idea that “they don’t make them anymore” and they are beautiful and fun to have in your collection.

- If (when) the government again decides to confiscate Gold, numismatic coins will likely be exempt like they were in 1933.

- Premiums for numismatic Gold coins expand and contract, sometimes dramatically. If you buy when premiums are contracted and sell when expanded you can make money even if the price of Gold does not go up.

The first argument, in our opinion, is a guess at best. The 1933 Executive Order of FDR was a bailout of the Federal Reserve at a time when Gold was used to back the currency. Today, no one cares about the Fed as is evidenced by the expansion of their balance sheet. Nor is U.S. currency backed by anything, let alone Gold. So acquiring more Gold – as we have seen – is not necessary to print more money.

And since we have moved excruciatingly and Orwellianly close to a full out Police State, why think they would exempt ANYTHING? When they outlaw private ownership of ALL guns, will they exempt your M1 Garand on the grounds that it’s the rifle that won WWII, and has no box magazine besides? Don’t bet on it.

The second argument, in our opinion, is a crap shoot. What really defines the premiums on numismatic coins is nothing other than supply and demand; how are you going to predict that?

What Form Of Gold SHOULD You Buy?

We agree with Ed D’Agostino and the wealthier customers of the Hard Assets Alliance who are trying to get the most Gold for their money by buying large Gold bars for quantity (as we learned in our interview with Ed), and identifiable sovereign Gold coins for any potential barter situation or divisibility. Ultimate divisibility goes to the Gold CombiBar, though.

Different forms of Gold are better than others depending upon your objective for that capital.

- BullionVault and GoldMoney are EASY, inexpensive ways of buying and storing Gold, profiting on a rise in the Gold price, diversifying wealth across borders and can be bought in small increments without paying higher premiums.

- Hard Assets Alliance allows you to not only take delivery easily or choose storage in vaults around the world but also choose which form it’s in – bars, coins of your direction.

- Texas Precious Metals is an excellent choice for buying coins and bars (Gold & Silver) for shipment to you very quickly and at probably the best prices you will find.

Both Hard Assets Alliance and Texas Precious Metals can help you put physical, allocated Gold in your IRA or retirement account.

Summary

None of us have bought any $20 Saint Guadens Gold coins or other numismatics ever since we became “educated” on buying and storing Gold. We bought them from a long time friend who was a coin dealer with overhead to cover; yes we paid too much for the Gold. Fortunately, Gold was in the $450 range back then in the early 90’s so the price gain has helped ease our pain.

Buy numismatic $20 Saint Guadens coins for beauty around the house, but our personal preference is to try to get the most Gold for our money in a form that fits the purpose of that investment capital.

After a drop in price yesterday, Gold and Silver uncharacteristically jumped UP on today’s job report. Fall is in the air and we may never pass this way again (hat tip to Seals & Crofts).

Consider TAKING ACTION today…