The question they always ask is “why buy Gold?”.

One of the best answers has been eloquently stated by James Turk of GoldMoney, one of the world’s premier services to buy and store gold overseas, aka “online Gold account”.

Gold and Silver are assets just like any other; currently more volatile than in decades past. Like any other asset, you want to buy when it is undervalued and hold until it is overvalued – then sell to the late comers. In this case, the late comer will probably be the skeptics who lost most of their money in their 401k turned 201, then 101k. The 401(k) with an option to put a portion of your retirement savings in a Gold/precious metals vehicle of some kind is quite rare from what we have seen; usually only a Gold STOCK fund, not actual metal.

In a desperate attempt to salvage their savings or be able to retire, these poor desperate souls will buy into what by then will be a Gold bubble, they will buy Gold from those investors wise enough to sell when Gold as an asset is overvalued and hold their Gold as it reverts back to the mean.

(Gold was briefly driven into a bubble by poor fiscal policy in the U.S. under then President Jimmy Carter in the late 1970’s.)

What Is The Fair Value Of Gold?

While many financial prognosticators have a method of determining the “fair value of gold”, many are really Gold haters who do not consider Gold and Silver to be money at all – when in fact they are the only items that truly are real money. Our guess is that soon those people will find out otherwise; we just have no idea on the timing of when.

If Gold is not money, then why to Central Banks the world over, including the United States, hold Gold in their vaults? Why are countries like Russia, India and China adding to their Gold reserves almost monthly?

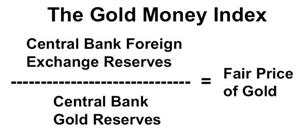

Turk’s Gold Money Index shown in the image above seems to make the most sense.

Using the Gold Money Index it is child’s play to see that the true value of Gold is really around $11,000 per ounce.

And that price is just if Gold achieves fair value. What we can likely expect is that the price of Gold will overshoot, just like nearly all other asset classes do, and become over valued at some point and at some price NORTH of $11,000 per ounce.

Makes you kind of nervous to have a few dozen 1 ounce Gold coins in the sock drawer, doesn’t it?

That’s why we prefer to buy and store our Gold in vaults secured by ViaMat, offshore in jurisdictions like Switzerland and Hong Kong, through GoldMoney and similar services reviewed here.

Find out more about buying and storing Gold or Silver with GoldMoney.