The Independent Speculator Warns Us on Country Risk

I saw a useless (IMHO) write-up on Pan American Silver (PAAS) over the weekend on Yahoo! (syndicated from Simply Wall St) that failed to mention mining stock country risk.

The article was asking if Pan American Silver deserves a spot on your watchlist…

Well, certainly PAAS is a high quality company that has put profits in our pockets for many years – despite lackluster silver price movement.

The problem is, though, that “country risk” was not even mentioned.

Also over the weekend Peruvians were voting on a new President. Their choices represent both sides of the mining friendliness spectrum and the polls looked close.

Pan American Silver owns a mine in Peru that could be very adversely affected.

Being a long time silver mining investor/speculator, I’ve gotten burned by elections before. Oft times the safest path is to go to the sidelines and wait for the election result.

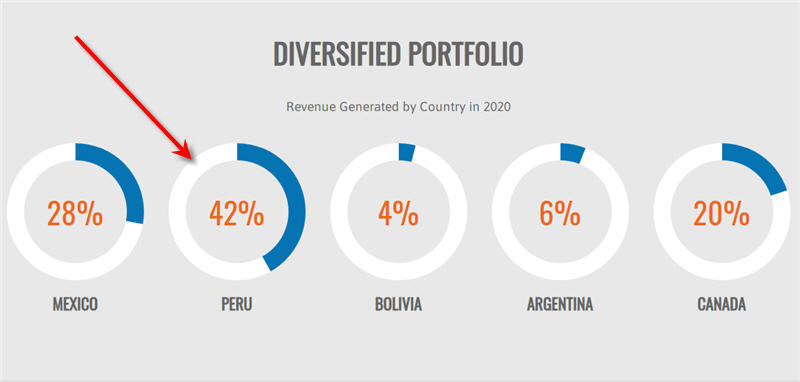

Because as you can see from the image above (from Pan American’s website), a whopping 42% of their revenue is generated in Peru.

How on earth can you begin to evaluate whether a silver mining stock like this belongs on your watchlist without even mentioning the potential for country risk?

We are happy subscribers to The Independent Speculator and took the advice to move to the sidelines on this otherwise great silver mining company to see how it all plays out.

Better safe than sorry for this speculator who has been burned too many times.

Lobo Tiggre, the brains & writer behind Louis James, LLC’s The Independent Speculator, is a cautious individual who has been in this space way too long to not realize something as important as country risk.

Those who remember “Louis James” from his days at Casey Research also probably know that one of the “8 P’s” used to evaluate a stock is “Politics” – aka country risk.

The bottom line is that if you are the type of investor to be considering a silver mining stock like Pan American Silver you need better information than what I call a “fluff piece” that might be on a site like Yahoo!

Sure, good information is not free, nor cheap. Yet one solid piece of well researched advice can save you more than the cost of admission by avoiding a serious mistake and/or make you a decent sized bundle buying the right stock at the right time at the right price.

Good information on mining stocks that takes country risk into consideration can be found by clicking here