Legally Avoid 1099B Reporting of Gold & Silver Sales

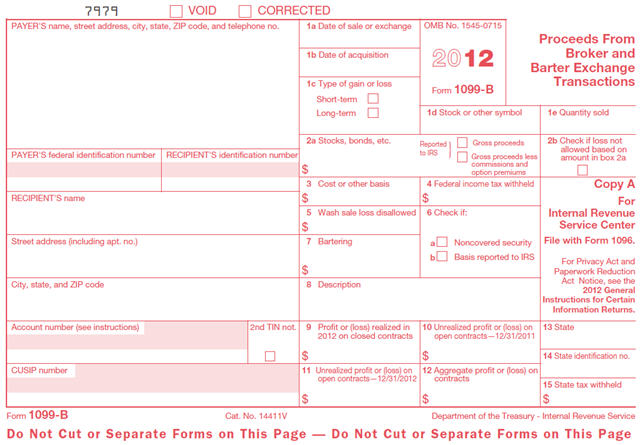

One thing that precious metals investors have always asked when buying gold, silver or other precious metals is whether or not an eventual sale of said metal will be reported to the IRS on form 1099B.

Important Note: First, we are not tax professionals and suggest you consult your own tax advisor before investing. Second, we are not advocating not paying any tax you legally owe. We simply are explaining what will and will not generate a 1099B report of your sale of gold or silver. We suggest you always obey the law.

Some investors are willing to comply with tax laws but are not willing to have their precious metals sales recorded and reported by precious metals dealers.

Why not?

The reporting requires, under certain circumstances, for the dealer to gather drivers license and social security information from the seller. Obviously, this puts the seller at risk that this information will not be adequately protected and could even lead to identity theft.

Further, if thieves got hold of such information they might target the home address listed on the drives license suspecting that a person selling gold or silver bullion might have more at home or other valuables.

So avoiding a 1099B for gold and silver sales does NOT make one a tax cheat, it is simply exercising wisdom towards one’s family’s safety and security.

Of course what has always fried investors in precious metals is that gold and silver, even ETF’s of same did not qualify for preferential long term capital gain treatment at lower tax rates but were tax like ordinary income!

Investors who own gold and silver in order to counteract the currency sabotage of the US Government often feel particularly perturbed that it then seems like the government wants to make SURE you have your savings slashed by their reckless spending and currency devaluation.

But I digress…

A Word Of Warning

Before selling any gold or silver to a precious metals dealer, find out what their company policy is FIRST! They may have an anal retentive owner or attorney who insists on collecting and reporting more information than the US Goverment and IRS require.

What Gold Sales Are Reportable On Form 1099B

So let’s see, based on 2012 tax rules that we have available, what sales of gold to a dealer by a private investor are required to be reported on an IRS Form 1099B:

Gold

- US Gold Eagle (all denominations) and US Gold Buffalo coins, are not reportable for any quantity of coins.

- Foreign coins sold in quantities of 25 ounces or more are reportable. Foreign coins include, but are not limited to: Australian Kangaroo, the ubiquitous South African Krugerrand, Austrian Philharmonic, Chinese Panda, Canadian Maple Leaf, British Sovereigns, Mexican Peso, etc.

- Gold bullion bars sold in weights of one kilo (32.15 troy ounces) or more per transaction are reportable.

So as you can see, the US Government gives preference to US Gold coins, which is somewhat expected and very nice. Additionally, though, the IRS is somewhat generous in places such high limits on what is reported; 25 ounces of coins or 32.15 ounces of bullion bars.

Remember, though, our warning above. ASK FIRST before assuming the dealer knows the law and intends to follow it.

What Silver Sales Are Reportable On Form 1099B?

The rules for Silver are a little different than Gold but you will see the similarity:

Silver

- Silver Bullion sovereign coins sold in any quantity are not reportable. Examples include, but are not limited to: Australian Kookaburra, Mexican Libertade, US Eagle, Austrian Philharmonic, Canadian Maple Leaf, etc.

- Bullion bars and rounds, .999 fine, sold in weights of 1,000 ounces or more per transaction are reportable.

- Junk Silver bags of 90% coins, $1,000 face value or greater sold in a single transaction are reportable. Here is one to take note of because lots of gurus, preppers, newsletter writers and the like recommend and sell these. Fortunately, they are often sold in bags of $250 or $500 face value.

So your mint box (green monster box) of US Eagles or maybe you have a box of Silver Canadian Maple Leafs is not reportable when sold AS LONG AS the dealer you are selling to knows the rules and follows them without applying stricter company guidelines.

Do Not Split Up Sales To Avoid A 1099B!

As I am sure you noticed, a gold and silver bullion investor can avoid any 1099B reporting requirements with a planned strategy of buying coins that are exempt.

We must add an important warning here: Similar to the handling of cash to avoid bank reporting, arranging the sale of bullion in multiple transactions to avoid hitting the reporting threshold requirements will expose the seller to further scrutiny and possible prosecution.

A dealer who determines that a seller is using a pattern of small sales to avoid a 1099B is required to file a Suspicious Activity Report.

REPEAT NOTE: We are NOT tax advisors and nothing on this website constitutes tax advice or investment advice of any kind. Consult your own CPA or tax attorney. Additionally, we are NOT advocating violation of any laws, tax or otherwise.

Never Touch The Gold or Silver

If you want to buy and store gold or silver elsewhere besides your home, the offshore gold storage firms of BullionVault and GoldMoney do not issue 1099’s and do not require you to store the gold in your home or handle it yourself in any way.