Lobo Tiggre and Why You Might Invest in Uranium

The Independent Speculator Uranium stocks are pretty much the only resource plays worth investing in right now. This is the message of TIS’ weekly e-letter for a while now.

(You can get the Speculator’s Digest for FREE by clicking here. It is well worth your time and you are NOT going to be spammed I can attest to that.)

Why would you invest in Uranium now?

The Speculator’s Digest from Louis James LLC is not the only publication sounding the alarm for uranium. Sovereign Man put out an article just today echoing what Lobo Tiggre’s been saying for a long time now.

- Gold is a great store of wealth but the price is just not moving much right now

- Silver is HIGHLY manipulated and a heart breaker for anyone storing Monster Boxes.

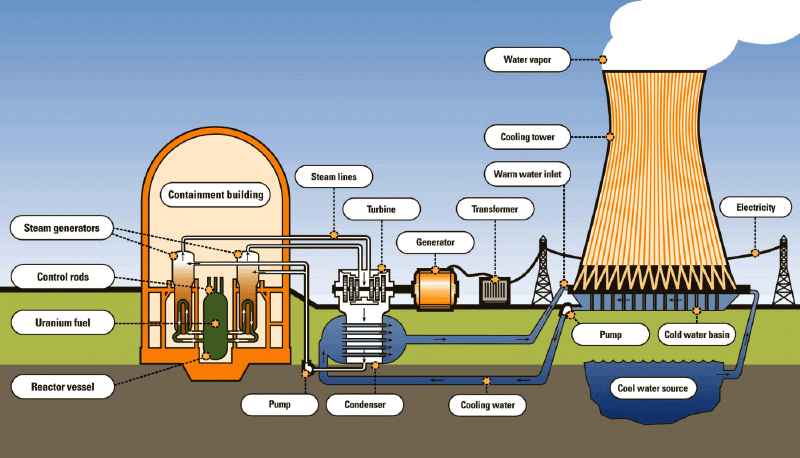

- A kilo of URANIUM, however, contains enough energy to supply a day’s power to 30,000 people!

- In 2021 nuclear plants used 73,698 metric tons of uranium to produce electricity. Yet total uranium mine output that year was just 56,377 metric tons.

- There are 59 new nuclear plants under construction, and 111 in early stage development. Another 300+ have been proposed. Sadly, the vast majority are in Russia, India, and China.

- Uranium stockpiles are at their lowest levels in nearly 20 years.

- Nuclear energy is essential for the ‘green’ movement, even if many or most involved don’t realize it (yet).

To that last point, SovereignMan points out that the Kori nuclear plant in South Korea has a footprint of just a few dozen acres, yet it produces 4x as much electricity as the largest solar field in the world.

That field, which represents an insane amount of MINED RESOURCES and carbon based transportation, occupies nearly 400 square kilometers of land.

International Speculator Uranium Stock Picks

One thing you do NOT want to do is just start buying up anything with ‘uranium’ or U308 in it’s name on on its website.

That strategy worked out well about 20 years ago for about 20 minutes; then your portfolio got creamed.

We personally just took a ‘Casey Free Ride’ as we used to call it or ‘Upside Maximizer’ as The Independent Speculator calls it on an Australian uranium stock pick.

That means we sold 1/2 or less (less in this case) of the stock we had to receive 100% or more (more in this case) of the money we had invested in that company. The remaining shares we’ll let ride at no risk (sort of).

Make no mistake, taking that ‘free ride’ or ‘upside maximizer’ is ESSENTIAL in resource stock investing. The market is all too happy to take away in a heartbeat what you’ve gained over years of time.

Yet, having GAINS is the KEY!

The problem with resource stocks as Doug Casey says “at best they are a burning match”. Most are NOT long term holds. (Even AT&T is not a great long term hold the last couple of decades!)

Picking the unicorn from the large basket of, let’s be honest, garbage companies – is NOT as easy as one might think. The International Speculator’s Lobo Tiggre is a first class rock kicker himself who visits companies and mines in the boondocks so his subscribers have the BEST INTEL.

Lobo and his team are also UPFRONT about the risks that go along with investing in these International Speculator uranium stocks or any resource company. You need to know these!

Stack the Deck in YOUR FAVOR

Have you ever bought a stock only to see it drop, almost immediately?

Sure, we all have! Yet there is a process that can help prevent that.

Human nature has us buying when everyone is excited about a company, yet that’s often when a premium has already been assigned to the stock’s price. WRONG TIME TO BUY!

Better is to do your research (better yet, have Lobo and his team of experts do it) then place limit orders to buy at a price YOU want to pay.

And once in the stock?

Use ‘stink bids’ to get more Independent Speculator uranium stocks at DISCOUNT PRICES!

(A ‘stink bid’ is a price way below the market that can get filled on a day the markets or the sector are taking a severe hit. Just be sure it’s not company specific news that might indicate you actually want to exit. Lobo helps with that!)

Also, I recommend at minimum subscribing to the dirt cheap ‘My Take’ Service from Louis James LLC. Hundreds of resource companies that might be in your current portfolio are rated with an obvious Thumbs UP or DOWN along with summary research.

I suggest (NOTHING ON THIS WEBSITE IS INVESTMENT ADVICE) you consider whether you want to keep an thumbs down stock. Remember, though, your parameters may differ from The Independent Speculator so THINK before you sell!

In summary, investing in the resource space can be highly rewarding. Avoid the treachery of the space by getting the assistance of EXPERTS!

For complete information, nothing held back, including ‘My Take’ database access, subscribe to The Independent Speculator full service newsletter and consume every drop of intelligence they provide.