Does Anyone Buy Platinum & Palladium Bullion?

Gold & Silver buyers are always interested in the ratio of Gold to Silver in price, performance and demand. Which is the better deal, which will make me more money, which is a better store of wealth?

What is everyone else buying?

So when we were fortunate enough to have Ed D’Agostino of Hard Assets Alliance on the line for our interview that was one key pieced of data that he revealed to us – what are the ratios of Gold to Silver to Platinum are customers of HAA are buying at.

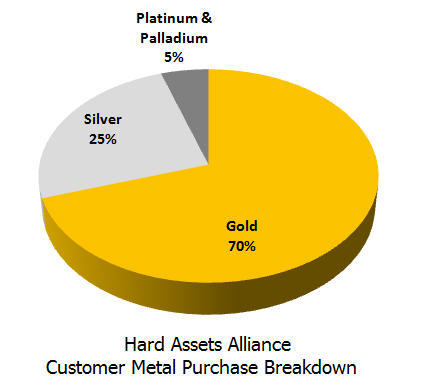

From the information Ed gave us we created the little graph below since visuals seem to be grasped quicker and more easily.

Gold Still Rules

Keeping in mind that one of the Hard Assets Alliance (link to our review) primary benefits to customers is reasonably priced precious metals storage in a fantastic selection of domestic and international vaults, maybe the higher cost of storing Silver has an impact on this metric.

Gold is outselling Silver – in dollar amounts – not quite 3 to 1.

Here is the graph:

Where Do Platinum & Palladium Fit In?

Possibly the most instructive element of the above infographic is the insignificance of Platinum & Palladium bullion sales to Hard Assets Alliance customers. 5% of their bullion sales are split between the two Platinum Group Metals (PGMs).

And, indeed, we found in our interview with Texas Precious Metals that they do not even carry Palladium at all and pretty much only offer Platinum due to the insistence of some of their larger clients that it be available.

So while they can be a good investment, they are not to be considered popular and may well not be recognized by the general populace when, one day, every knows what the price of Gold and Silver are. (Speaking of the entertainment-centric United States citizenry here, we are well aware of the affinity for REAL money and TRUE wealth in other parts of the globe.)

That said, many buy Platinum & Palladium just because the coin or bar is attractive, and we have nothing against that just as long as you understand what you are buying, what premium you are paying for it and what you are likely to receive for it should you choose to sell it someday.

How Does This Equate To Volume?

If you want to know what ratio HAA customers buy Gold and Silver in volume terms one can pretty much just apply some price factors and a little math to determine that, by volume, about 22 times more Silver is purchased than Gold by volume.

Do You Have Your Share of Gold & Silver?

Mr. Market, the forces that be, maybe end “the Dark Side” have given us yet another chance today to accumulate more physical Gold and Silver at favorable prices.

Do you have an appropriate amount for you portfolio? (Note: very few people do…)

If not, we enthusiastically use and recommend the Hard Assets Alliance. Learn more here.